What proportion of my assets do I invest in private equity and venture capital? And how do these investment categories compare to shares, real estate, bonds or savings? Professional investors allocate 10% to 30% of their assets to investment companies, split into around 70% buyout and growth equity investments and around 30% venture capital. This allocation is far from random. If we look at the science behind portfolio allocation, we see that this distribution may be the most efficient.

Risk and return

It is basically a two-level question. Firstly, we need to know how much in total we want to invest in private markets (the collective name for investment categories such as private equity and venture capital) and secondly, how to allocate between private equity and venture capital within that investment category. As always with investing, this is a trade-off between risk and return. Too much capital in relatively safe categories like savings and real estate may not yield enough returns. However, taking all investments outside the stock market at once, may not be a good idea either.

Diversification is key

In principle, diversification of investments ensures fewer peaks and troughs in the overall value of your investments. This is due to the phenomenon of correlation, which describes the interconnection between investment categories. Not every investment category responds to market conditions in the same way. An umbrella manufacturer benefits from a bad summer, while at the sunscreen factory, they hope for some sunshine: putting together a mix of investments that takes these correlations into account is therefore very important. There are also differences between categories: for example, rising interest rates are good for savings but bad for property prices.

Efficient frontier

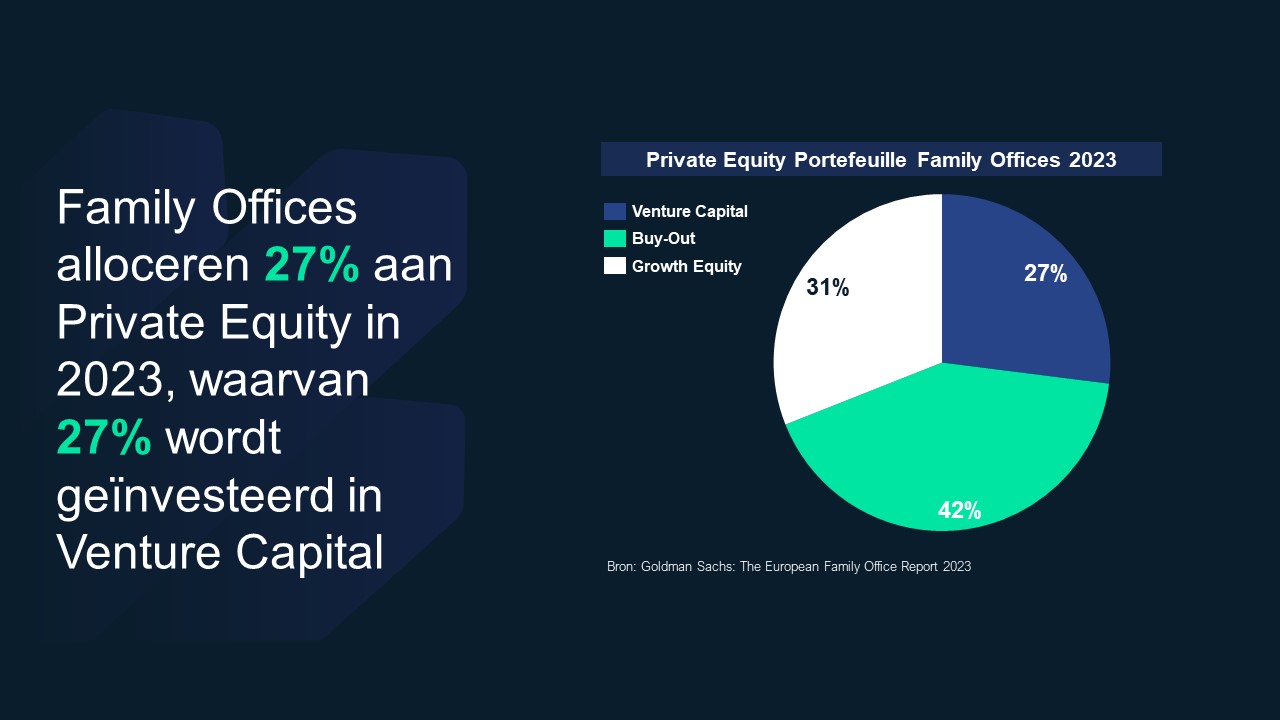

So, as an investor, you look for the optimal investment mix between different asset classes. For example, one investment mix leads to a high risk with a low return, while another mix can end up with a higher return against the same risk. An optimal investment mix maximizes returns at the lowest possible risk. Such an investment portfolio is called 'efficient' and therefore offers the best risk-return profile. Different efficient portfolio types are possible. Depending on an investor's return target and risk appetite, the optimal mix between private equity and venture capital differs for each investor's investment portfolio. Private equity and venture capital both enhance the investment portfolio in terms of diversification and can have a positive impact on the risk-return profile. The private equity and venture capital portfolio of more experienced private market investors, such as family offices, accounts for between 10% and 30% of their assets[1]. Within this category, a split of around 70% in buyout and growth equity (private equity) and around 30% venture capital is often applied.*

[1] Cambridge Associates Global Private Equity and Venture Capital Benchmark, 2020

*None of the information on this page should be interpreted as investment advice under any circumstances. Ultimately, an investor should carefully weigh their investment objective and risk appetite in consultation with their adviser to determine the appropriate strategy for them.