Over the past few decades, private equity has proven to be one of the best-performing asset classes. Average historical returns are structurally higher than in the stock market and tend to be more stable¹. On the other hand, the category is characterised by: 1) its less liquid nature - it can take longer to sell a private equity fund position early (fund terms typically run for 10 years or longer), and 2) it can take a relatively long time before committed capital is called up ('deployed') and then distributed as returns. Private equity secondaries can provide a solution to this.

1. The secondaries market allows private equity investors to sell fund positions more easily.

Institutional investors often have other reasons for early liquidation. For example, a pension fund has a strategic investment policy that sets ranges for each asset class. These indicate a minimum and maximum percentage of the total portfolio within which these categories can move. As certain investment categories outperform others, and move outside the set ranges, the pension fund will have to 'rebalance'. This means that categories that fall through the lower limit are acquired, and those that move through the upper limit are sold to return to the original ratio. In recent years (especially the 2021-2022 period), private equity has performed relatively well and bonds and listed equities less so. As a result, the proportion of private equity in the overall portfolio has risen sharply. This is also known as the 'denominator effect'. To get back within the range, many pension funds have had to sell their private equity fund positions. As many positions are sold at the same time, buyers can in some cases negotiate significant discounts. Secondaries funds are such buyers of existing positions.

2. For investors in secondaries funds, who buy fund positions, accelerated capital calls and distributions are possible.

This is because the positions that secondaries funds invest in have been part of the underlying fund for some time. As a result, it takes less time for cash flows to start. Secondaries funds additionally offer the opportunity to benefit from:

- discounted entry, which in some cases allows secondaries funds to present an already upgraded portfolio during the fundraising period;

- diversification benefits - typically a secondaries fund includes many more companies than a regular private equity fund; and

- greater transparency as you often have early insight into the companies that make up the portfolio.

Marktlink Capital has been investing in the secondaries market since its inception in 2020. During that time, we have built a track record of investments in 5 top secondaries funds with EUR 160 million of committed capital.

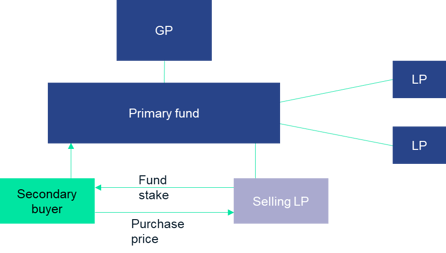

How secondaries transactions work

The secondaries market is part of the private equity sector. Secondaries funds buy existing positions in private equity funds from investors in those funds. Classic private equity funds are also called primary funds. The manager of a primary fund is also known as the general partner ("GP"). As part of a secondaries transaction, all applicable rights and obligations are transferred from the original LP to the relevant secondaries fund (see chart below). A well-known example of a secondaries transaction is a pension fund selling positions as a result of the denominator effect, providing liquidity to the original LPs (in this example, the pension fund).

Diagram of a secondaries transaction.

Source: Pitchbook (2023). The Evolution of Private Market Secondaries.

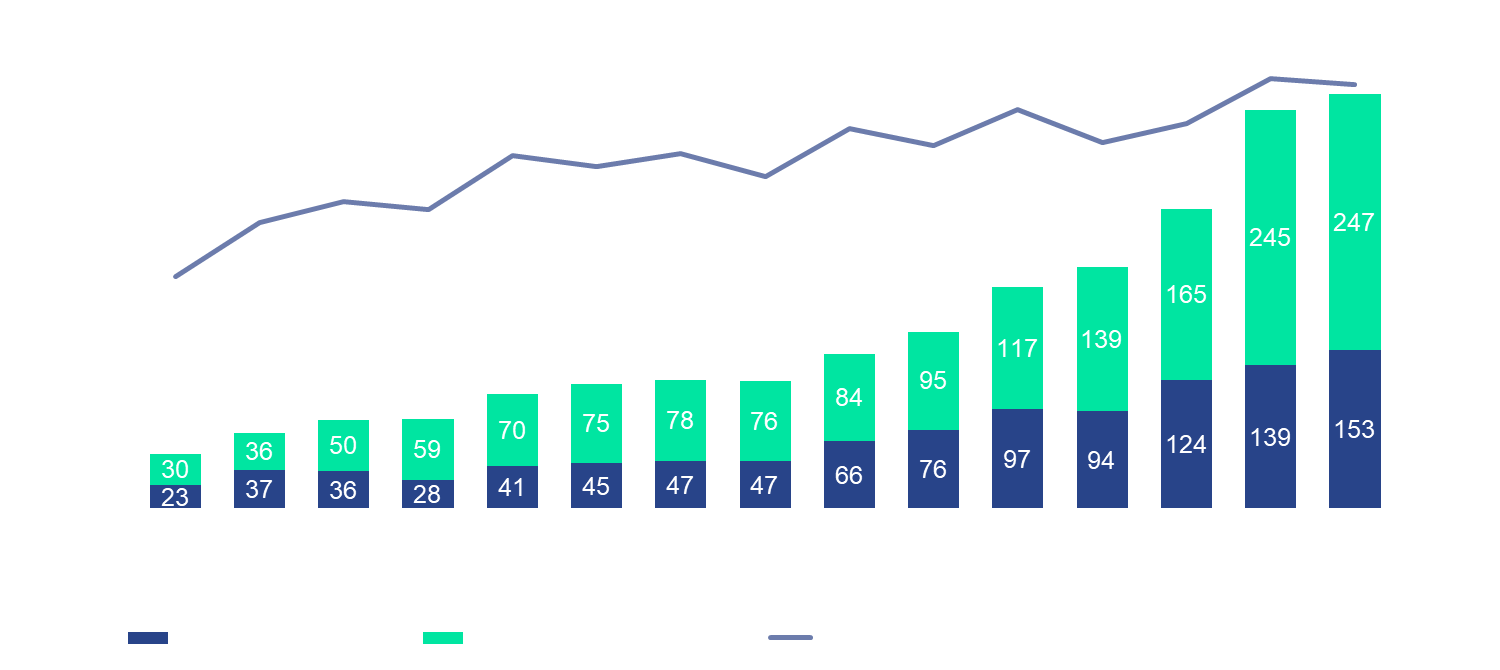

Market perspective: the secondaries market is growing

Secondaries have become an increasingly attractive segment of the private equity market as they provide flexibility for LPs looking to liquidate or rebalance their portfolio. The secondaries market is relatively young and has experienced significant growth over the past 15 years. By 2022, the global secondaries market had reached a record size of over USD 400 billion (see chart below). A major reason for the recent growth spurt has been the denominator effect. But also structurally, the need for liquidity from private equity investors continues to grow. This is partly due to the strong growth of private equity over the past decades, of which the secondaries market is a derivative.

Moreover, the share of secondaries within the broader private equity market has increased over that period, but still represents only 8% of the total as of 2022. We believe the secondaries market will continue to grow.

Private equity secondaries assets under management (‘AUM’).

Source: Preqin (2023). Private Equity Q2 2023: Preqin Quarterly Update.

The average annual growth rate of capital raised by secondaries funds has also been high. This has increased the demand for investment opportunities within the secondaries market. Yet supply appears to be (much) higher than current demand².

In recent years, another type of secondaries transaction has emerged and now accounts for a significant portion of the secondaries market. This type is a 'GP-led transaction', where interests in one or more portfolio companies of a GP are transferred to a newly created fund and the original LPs are presented with the option to participate in that new fund or to transfer their interest to new LPs. Since the initiative for this secondary transaction lies with the GP, we refer to this as a GP-led transaction. Such a transaction may be desirable if the GP thinks there is more value in a portfolio company and the previous fund is at the end of its term or has no more capital for new investments. It is also a way of providing liquidity to LPs at a time when an IPO or sale of a company is less obvious.

GP-led transactions have more similarities to primary transactions. For instance, capital usually takes longer to invest, positions stay in the fund for longer and entry is usually made at cost price. For the remainder of this article, we will focus on the 'classic' form of a secondaries transaction as described earlier.

The four advantages of investing in secondaries

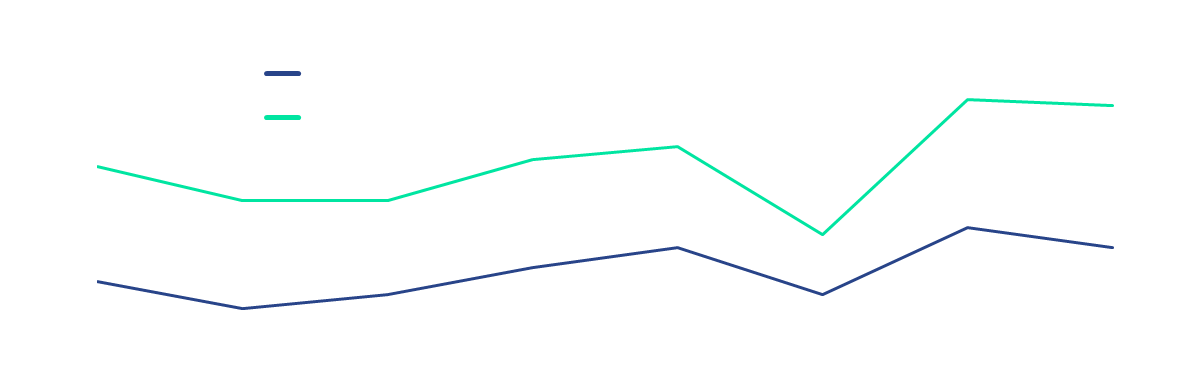

- A perceptive investor might ask, "how can a fund be upgraded right after entering?" Within secondaries, this is possible. For one thing, a fund may already have made investments that are showing results, while the fundraisinge period for that fund is still ongoing. Another reason is the discount (transaction value below NAV) that secondaries funds can negotiate from sellers of fund positions in some cases. Discounts are often possible within the secondaries market when there is a need for liquidity, for instance due to a need for rebalancing from an institutional investor or bankruptcy of an individual LP. The average discount in secondaries transactions within buy-out private equity was around 10% in the first half of 2023, and 31% in venture capital (see chart below). As a general rule, the more complex a situation is, the fewer bidders and the higher the transaction discount.

Average discounts on LP portfolios (% below NAV).

Source: Jefferies (2023). H1 2023 Global Secondary Market Review.

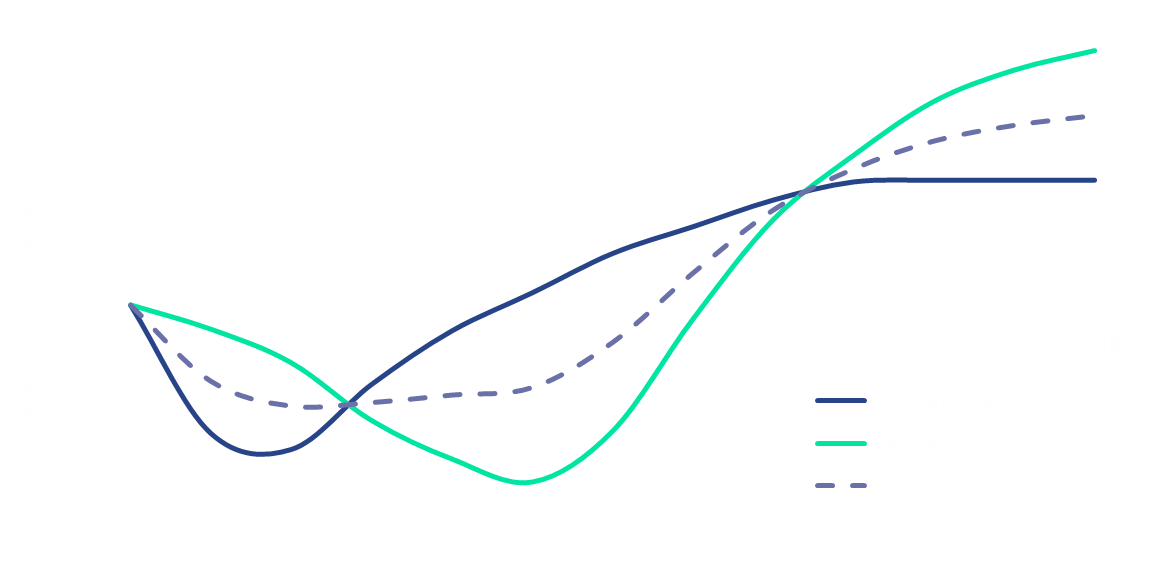

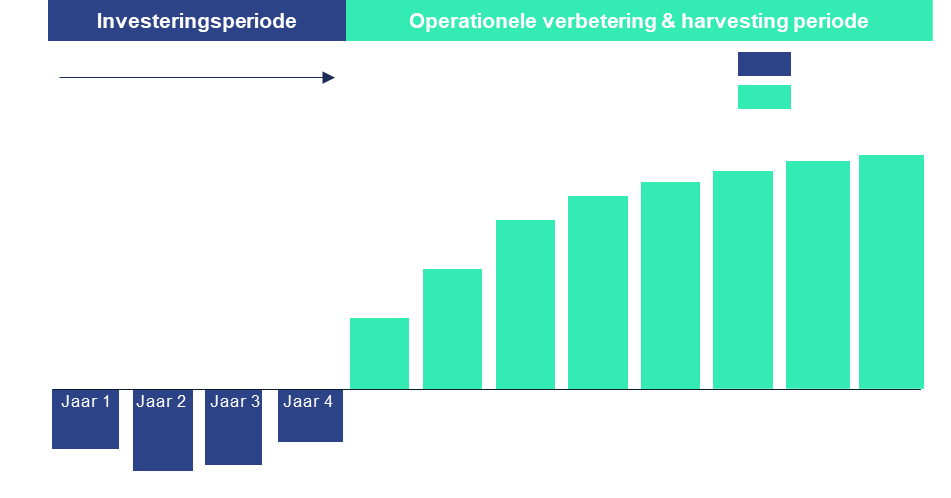

- 2. Another advantage of secondaries is that capital, compared to a primary fund, is expected to be called and also distributed to investors relatively quickly. This is because the fund positions these funds invest in have already been part of the underlying fund for some time. This ensures that a secondaries investment is often complementary to other private markets investments. Early distributions can then be linked to the capital calls.

To provide an indication, the dotted line in the chart below shows a combined investment of 50% in a primary fund and 50% in a secondaries fund. It is worth noting that i) the maximum capital drawn down is lower than for a separate investment in either fund, ii) the moment when the initial investment is back with the investor occurs earlier than for a separate investment in the primary fund (the dotted line crosses the horizontal axis earlier), and iii) the expected return is higher than for a separate investment in the secondaries fund.

Indicative cashflow profile of an investment in a secondaries fund versus a primary fund.

Source: Marktlink Capital (2023).

Oliver Gardey, Managing Partner at ICG, a global private markets asset manager, has more than 25 years of experience in the private equity industry, and specifically within secondaries. Gardey points out: 'In our strategy, we focus on the 'sweet spot' of portfolios that are on average around 5-7 years into their maturity. As a rule, after that, the so-called 'harvesting' period begins when, in addition to discount on entry, there is still significant potential for value increase in the portfolio.'

Indicative cashflow profile of a primary fund and a possible moment of entry by a secondaries fund.

Source: ICG (2023). Investor Presentation.

- Adding secondaries can also offer diversification benefits. For instance, one of ICG's current transactions is underlyingly invested in 77 companies. This kind of diversification can help reduce risk at the lower end of a broader investment portfolio.

- Finally, investors in secondaries have the advantage of partial or full insight into the companies they invest in. 'Blind Pool Risk' refers to the fact that LPs in primary funds commit capital to a portfolio that has yet to be built. This creates a 'blind pool' of capital. In the case of secondaries, especially those purchased later in a fund's term, money is invested in companies that are already well-known. This allows LPs to analyse performance to date and calculate the future value potential of the underlying companies.

Risk and other considerations

Many of the risks that apply to primary funds, apply to secondaries as well. Consider, for instance, the risks of transactions being overvalued before entry, the value of secondaries' positions falling after entry, or a weakening macroeconomic outlook.

Cost is also a consideration with secondaries. Although secondaries funds typically charge a lower management fee than primary funds, fees are still payable to the underlying fund managers with whom trades are made, in addition to the fund manager's own costs.

Conclusion

The secondaries market allows LPs to sell fund positions more easily. For investors in secondaries funds, capital can be quickly put to work and redistributed. Furthermore, the portfolio of a secondaries fund can increase its value early on in some cases, and provides great diversification.

Secondaries, like any other asset class, involve risks and careful consideration. However, within this market, for those who know where to look, there are hidden gems to be found. These offer the advantages as discussed earlier, and are hard to find elsewhere in the spectrum of investment opportunities. With the right fund choice, Marktlink Capital considers secondaries a potentially valuable addition to a private markets portfolio.

Should you be interested in investing in the secondaries market or learning more about the trends and developments, we are at your disposal. We currently have the opportunity to invest in a fund with a secondaries focus. We would be happy to give you more details if required.

Disclaimer

This document is not an offer or solicitation of an offer to acquire a unit in an investment vehicle, to purchase a financial instrument and does not constitute advice on financial instruments.

The information contained in this presentation reflects the prevailing current market and our view of it, which may be subject to change. The information contained in this document has been compiled from sources believed to be reliable without further investigation as to the accuracy of such information. No express or implied warranties or guarantees are given as to the accuracy or completeness of this presentation or its contents. Also, neither this presentation nor anything in it shall create any obligation for Marktlink Capital or be, or intended to be, the basis of any agreement with Marktlink Capital.

Investing in private equity involves risk. Past results do not guarantee future performance.

Marktlink Capital is registered with the Netherlands Authority for the Financial Markets as a 'small manager' in accordance with Article 2:66a of the Financial Supervision Act. Marktlink Capital does not hold a licence as referred to in Section 2:65 of the Financial Supervision Act to manage investment institutions, and as such, Marktlink Capital and its investment institutions are not supervised by the Netherlands Authority for the Financial Markets or De Nederlandsche Bank N.V.

Sources

1) Bron: Bain & Company (2023). Global Private Equity Report 2023

2) Bron: Hamilton Lane (2023). What Does Secondary Market Growth Mean for You?