Private equity

fund-of-funds

Marktlink Capital enables entrepreneurs and private individuals to invest in the best private equity funds via fund-of-funds. Take advantage of this investment category's annual target return of 10-15% on the invested capital (after fees).

Investment

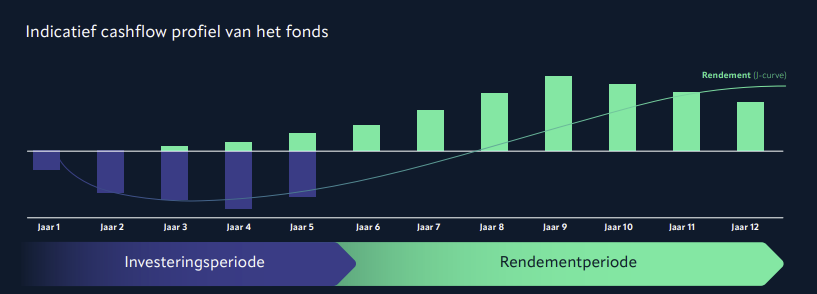

Joining forces, spreading riskBy subscribing to our funds, private investors commit their capital for the duration of the fund-of-funds (usually ten years). Marktlink Capital then looks for the right private equity funds to partner with. Subsequently, these partner funds invest in companies - requesting the required capital from investors. If the fund sells one of its companies, the proceeds flow back to the investors via the fund. This way, over the life of the fund-of-funds, we realise solid returns for our participants. Watch the animation for a more detailed explanation.

Selection and spread of funds

For each of our fund-of-funds, we cooperate with 10 to 20 private equity firms. We only work with investors that are consistently among the 25% best-performing funds in the market. This group is made up of Dutch funds, European funds and funds from the United States. Our partner funds operate across a broad range of sectors. In this way, we spread risk and returns across multiple dimensions.

Expected returns

Across sectors, private equity has been able to achieve excellent returns in recent years, far ahead of other investment categories such as shares, real estate or savings. For our fund-of-funds, we expect an annual rate of return of around 10-15%, after fees.

Learn more about private equity returns.

.webp?width=1250&height=1270&name=Private%20equity%205%20(2).webp)

Now open:

Private equity Fund V

More details about terms and conditions

- Access to the best private equity funds

- Expected returns of 10-15% per year (after fees)

- Minimum investment EUR 250,000

Contact us

Thanks to our years of experience in the private equity and venture capital sector, we know the market like no other. We will always be up-to-date on current market trends. We gained our extensive international network at for example AlpInvest, Avedon, McKinsey, Rabobank and Rede partners.

Get in touch