Invest in entrepreneurship through Venture Capital

Take advantage of attractive returns in venture capital by participating in our fund-of-funds or feeder funds as a private investor.

Invest starting from €250,000

For and by entrepreneurs

Venture Capital funds focus on rapidly growing tech companies with high potential, making it an ideal investment for entrepreneurs eager to contribute to innovation. Participants in our funds form a strong network of experienced entrepreneurs and investors, who add value through their expertise and connections. This network actively supports businesses during their growth phase.

Access to top funds

Venture Capital funds vary greatly, but Marktlink Capital invests exclusively in the top-performing and hard-to-access funds. We select leading funds from Europe, Israel, and North America, with a focus on technology and innovation. Through our data-driven approach and extensive market knowledge, we ensure access to funds that consistently deliver high returns. Strategic diversification minimizes risks and maximizes the potential for success.

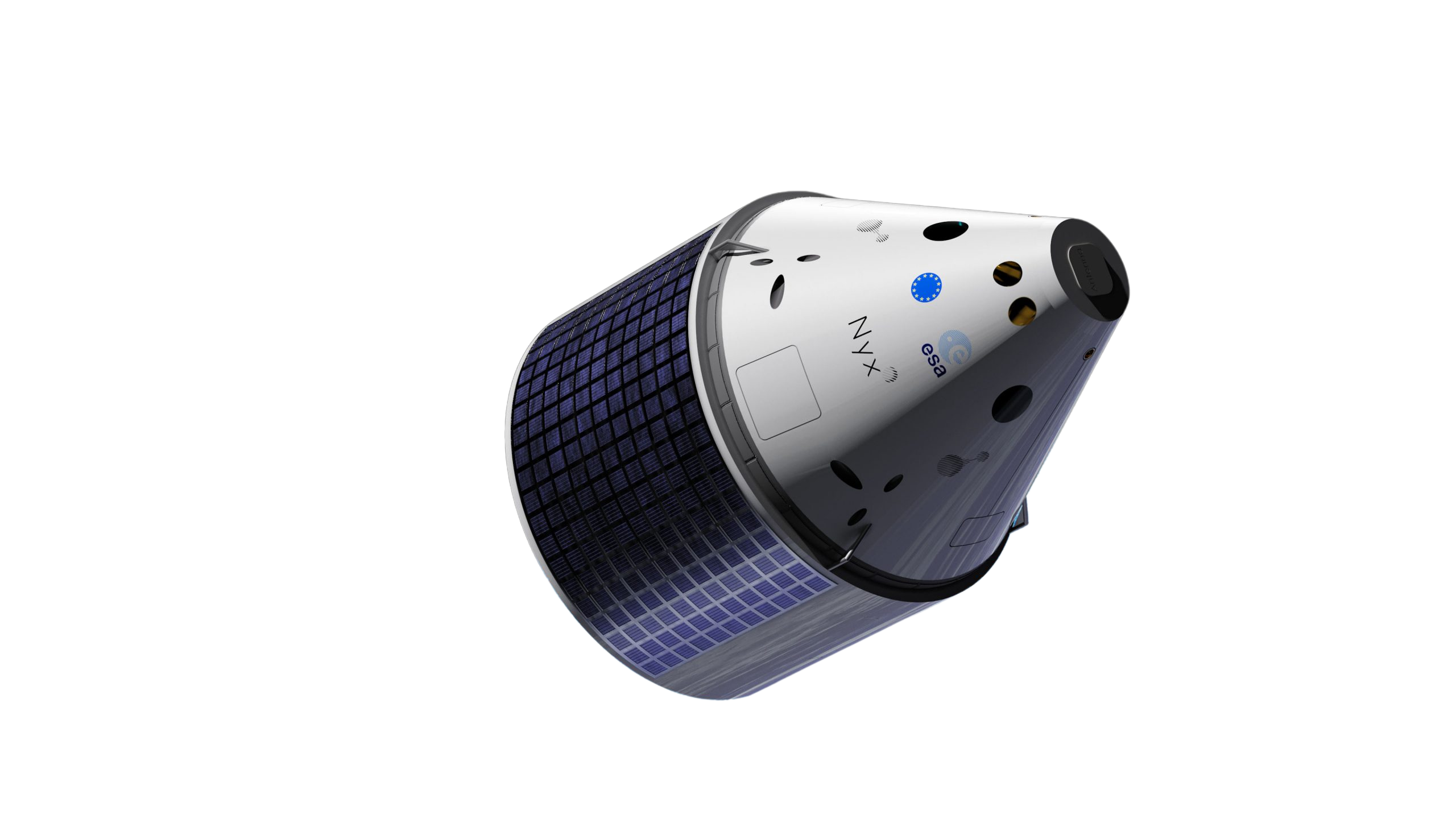

The Exploration Company

The Exploration Company develops modular and reusable spacecraft for commercial and institutional clients. They focus on affordable and sustainable space solutions. Their vehicles can transport cargo to low Earth orbit, the Moon, and beyond.

Voliro

The Swiss company Voliro develops advanced drone technology for the inspection and maintenance of industrial installations such as wind turbines and factories. The drones can not only fly but also land on various surfaces and perform complex tasks, such as conducting non-invasive tests and applying coatings.

Robeauté

Investing in Venture Capital

Accelerating promising companies

Venture Capital funds invest in fast-growing technology companies with significant potential, providing capital and strategic guidance to support expansion, product innovation, and talent acquisition. Active involvement and access to a wide network foster sustainable value creation and increase the likelihood of successful exits, such as acquisitions or IPOs.

Long-Term Returns and the J-Curve

Venture Capital funds target a net return of 10-20% per annum over 10-12 years. In the early years, returns may be negative due to the J-curve, with initial costs and slow growth dominating. However, as companies grow and exits occur, returns increase significantly. This makes Venture Capital ideal for long-term investors looking to capitalise on strategic value creation.

Access to top funds

Venture Capital funds vary greatly, but Marktlink Capital invests exclusively in the top-performing and hard-to-access funds. We select leading funds from Europe, Israel, and North America, with a focus on technology and innovation. Through our data-driven approach and extensive market knowledge, we ensure access to funds that consistently deliver high returns. Strategic diversification minimizes risks and maximizes the potential for success.

Everything you need to know about venture capital

Understanding Leveraged Buy-Outs in Private Equity

You may have come across the term leveraged buy-out in the context of private...

Understanding the J-Curve: Cashflow Insights for Private Equity Investments

A picture is worth a thousand words; this is certainly true for graphs as well....

Private equity: What is a Buy & Build-strategie?

You might have come across the term in newspapers or on private equity fund...

Our portfolio

Take advantage of attractive returns in venture capital by investing in funds as a private investor.

en icon

%201.png)

en icon

%201.png)

en icon

%201.png)

Frequently asked questions

Venture capital is a form of investment focused on early-stage companies with high growth potential, often in innovative sectors such as technology, biotechnology, and renewable energy. These investments provide capital to accelerate product development, market entry, and expansion. The aim is to help these companies scale quickly, creating significant value before achieving a return through an IPO or acquisition.

The expected return ranges from 10% to 20% per year. This is calculated as the net return (IRR) after deducting all fees and costs. It reflects the projected performance on the invested capital over the life of the fund.

For a complete overview of our Private Equity (PE) and Venture Capital (VC) funds, as well as any feeder funds, you can refer to the funds overview page. There, you'll find detailed information about the structure of each fund and the investment opportunities.

Investing is available to qualified investors who meet the minimum investment requirement. The minimum investment amount is typically set to ensure serious participation and alignment with the fund's objectives. Additionally, all investors undergo a thorough due diligence process to assess their suitability for the fund.

The minimum investment is €250,000. This amount ensures that investors are committed and aligned with the fund's objectives. Additionally, it provides more opportunities for diversification and access to exclusive opportunities within the fund.

Venture capital investments are typically made in early-stage companies with high growth potential, focusing on innovation, product development, and market expansion. These investments often target sectors such as technology, biotechnology, and renewable energy. The goal is to accelerate the company’s growth and increase its value, ultimately achieving a return through an IPO or a sale to a larger company.

Ready to start investing? We're here to help!

-

Gain exclusive access to 75 high-performing funds

-

Achieve 10-20% annual returns

- Join over 1,700 investors who trust our expertise